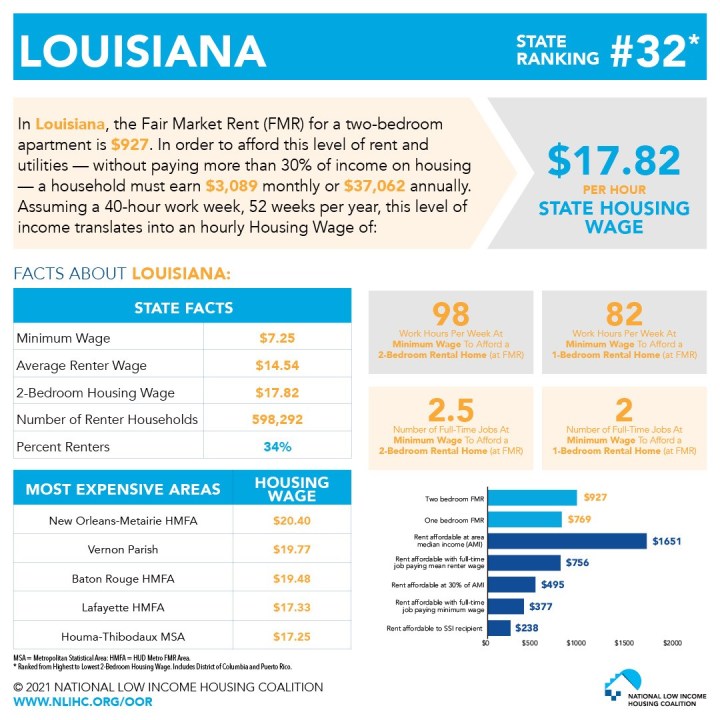

NEW ORLEANS (WGNO) — According to a report from Out of Reach and the National Low Income Housing Coalition, to afford a modest, two-bedroom apartment at fair market rent, full-time workers in Louisiana need to earn a minimum of $17.82 per hour.

New Orleanians must earn $20.40 an hour to afford a modest two-bedroom apartment.

Reports show, before the pandemic, more than 7.6 million extremely low-income renters were already spending more than half of their limited incomes on housing costs, sacrificing other necessities to do so. After a year of job losses, furloughs, and limited hours, it is expected for many of these households to be even worse off than they were before.

“While Louisiana saw some moderate decline with its overall rental prices, New Orleans housing stubbornly remains out of reach,” said Andreanecia Morris, HousingNOLA Executive Director.

Morris added that things need to be done.

“This report reinforces the need to #PutHousingFirst by doing things like renewing the New Orleans Neighborhood Housing Improvement Fund (NHIF), combatting exclusionary zoning, and effectively managing all federal resources to keep people housed. We must promote a just recovery by rejecting plans to use covid relief on anything other than the basic needs of those most impacted by the pandemic. This data also crystalizes why the efforts to increase wages must be fully implemented in the city of New Orleans.”

As stated in the report, essential workers (grocery store clerks, service industry workers, trash collectors, etc) do not make $20.40 an hour. Additionally,the typical renter in Louisiana earns $14.54, which is $3.28 less than the hourly wage needed to afford a modest two-bedroom unit.

Housing advocates are asking Governor John Bel Edwards to use that federal funding in the following ways:

· Mortgage payment and other financial assistance to reinstate a mortgage following forbearance,

delinquency, or default

· Reductions in principal or interest rate

· Utility and internet service payments

· Homeowner’s insurance, flood insurance, and mortgage insurance

· Homeowner and condominium association fees or other common charges

· Other assistance needed to promote housing stability for homeowners

· Reimbursement for prior expenditures made by states to stabilize homeowners during the

pandemic

According to the news release, the federal minimum wage has remained at $7.25 an hour without an increase since 2009.

Working at the minimum wage of $7.25 in Louisiana, a wage earner must have 2.5 full-time jobs or work 98 hours per week at a minimum wage job to afford a modest two-bedroom apartment.

“Housing is a basic human need and should be regarded as an unconditional human right,” said Diane Yentel, NLIHC president and CEO. “With the highest levels of job losses since the Great Depression and a pandemic that continues to spread, low-income workers and communities of color are disproportionately harmed. The enduring problem of housing unaffordability ultimately calls for bold investments in housing programs that will ensure stability in the future. Without significant federal intervention, housing will continue to be out of reach. This leaves millions susceptible to the overwhelming consequences of Congressional inaction.”